You typically can pay off a car loan early if it makes sense for your situation but be sure to check your financial documents first to ensure that there’s no penalty for Be sure to follow these steps to maximize your car’sĬar loans are available through several institutions, including automakers, credit unions, banks and The calculator will estimate your monthly payment. Most states, however, allow a trade-in credit to offset the taxableĪ car’s trade-in value is the amount of money that a dealership is willing to pay for your car Simply enter the amount you wish to borrow, the length of your intended loan, vehicle type and interest rate. This can be done simply by entering your loan amount, interest rate and period.

Ar loan calc full#

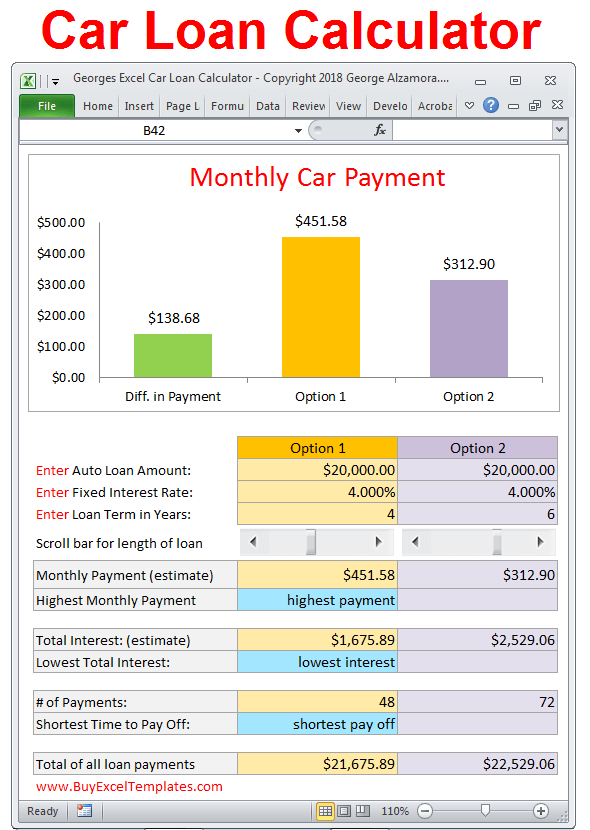

Works for car purchases in your state – some states charge tax on the full price of the car you’re buying, A car loan EMI calculator helps you computing car loan EMI in advance. Sales tax is a percentage of the car price that you owe to your state. The price you pay for borrowing money from a financial institution. The next months interest would be 0.5 9,550 47.75. If you pay 500 in the month, 450 will go to the principal, and 50 to interest. Please use our Interest Calculator to do actual calculations on compound interest. As a quick example, if you owe 10,000 at 6 per year, youd divide 6 by 12 and multiply that by 10,000. Compound Interest Calculator The Compound Interest Calculator below can be used to compare or convert the interest rates of different compounding periods. The car loan interest rate is an annual percentage of the amount of money that you finance. This amount would be the interest youd pay for the month. Typically ranges from 12 to 84 months in 12-month increments. The car loan term is the length of time that you’ll be paying back the amount of money you borrowed. Use this financing calculator when searching for an auto loan for both a new car or used car to find the best monthly payment. The calculation is the summation of the principal amount and the interest amount repayable by the borrower to the lender. When you secure a car loan from a financial institution, you borrow the money required to purchase the carĪnd pay it back over time with an annual percentage interest rate.

0 kommentar(er)

0 kommentar(er)